Jay Z. Yuan, Clinton A. Haynes, Steve DeHoff, Rich Chomik

Stress Engineering Services, Inc.

The European Union has updated the European Green Deal and its vision for the Ecodesign Directive which is intended to provide greater regulatory reach and oversight with respect to the environment and sustainability for products and packaging being sold in the EU. The revised program is called the Ecodesign for Sustainable Products Regulation (ESPR) and overarches other EU environmental initiatives, including the creation of a “Digital Product Passport” (DPP) focused specifically on all products sold in the EU. The requirements of the DPP will roll out over time with key milestones as far out as 2050. All future products sold in the EU will need to comply to the new Digital Product Passport requirements of the ESPR. In addition, new EU-wide rules have been proposed for packaging that is focused on packaging waste reduction. All of these regulations impact consumer goods and food and beverage manufacturers.

Collectively, compliance with the requirements of the “Digital Product Passport” (DPP) initiative as well as the Packaging and Packaging Waste Directive (PPWD) [A Short Guide to the EU Proposal for a Regulation on Packaging and Packaging Waste Directive – Anthesis] will have a very significant impact on all aspects of new product and packaging development as well as legacy product, package design, and e-commerce packaging distribution. In addition, both programs require significant documentation and communication of historically proprietary data through what is planned to be secure data structures to provide evidence of compliance (for compliance administration) as well as information for the consumer/user to make more informed decisions about their purchases with respect to sustainability and environment.

Sustainability initiatives in the US, although not mandated by the government as in the EU, are being demanded by the consumer and reflect and promote many of the same principles and strategies as outlined in the PPWD. For that reason, this White Paper explores some of the significant technical headwinds to achieving the sustainability outcomes of the PPWD, from a US packaging perspective.

Digital Product Passport and the Packaging and Packaging Waste Directive

The DPP and PPWD are far-reaching documents impacting every activity associated with the design, manufacture, distribution, and end of useful life, of all products and packaging to be sold in the EU. The requirements of these programs will be phased in over time with targeted full compliance for 2050 and 2030, respectively. For multinational Consumer Products Goods companies (CPGs) with operations and/or sales around the globe, compliance with these directives will require significant changes in product and package development and package engineering and will also require significant organizational effort to implement.

The Digital Product Passport

The DPP Directive is focused on products and is relatively silent with respect to packaging. The Commission stated that “packaging will not be included in the ESPR working plan because most packaging-related sustainability issues are adequately covered in the Packaging and Packaging Waste Directive” EU’s upcoming ‘digital product passport’ will include packaging, official says – EURACTIV.com, which is specifically focused on primary, secondary and tertiary packaging waste.

The Packaging and Packaging Waste Directive Impact-A US Perspective

For CPG manufacturers of non-durable products, particularly liquid products (e.g., liquid laundry, beauty, home care, hair care, personal health, food & beverage), the packaging directives related to plastic materials and plastic replacements outlined in the PPWD represent a strategic challenge. The PPWD places a very strong emphasis on:

(1) reusable/refillable packaging,

(2) eliminating “unnecessary” packaging and limiting “overpackaging” and

(3) decreased use of virgin materials.

There are numerous other goals and regulatory requirements outlined in The Directive, all of which also represent significant change to primary packaging strategies.

PPWD and a Unique Moment in Time: Brick & Mortar vs. Ecommerce

The PPWD directive occurs at a time when the CPG industry is struggling with the transition from 100% traditional store “shelf-based” display packaging that is typically transported in corrugated cases or trays on pallets, to steadily increasing volumes of product being distributed through ecommerce parcel delivery channels. Most companies are still using traditionally designed packages in both brick and mortar and ecommerce distribution models. At this specific time in history these two product distribution modalities, business-to-business (distribution center and/or store) and ecommerce parcel delivery are, more often than not, divergent and mutually exclusive in the context of packaging “system design” and performance. Technical design requirements for one distribution modality can be different or counter to the other. Some of the divergent scenarios include;

Structural Damage to Liquids Packaging

Commonly understood and mature rules of package design for case-level distribution of products often do not apply and frequently fail in ecommerce distribution models.

Well-characterized structural loading requirements of filling, capping, case packing, palletizing, warehousing, transport, shelf-stacking for packaging was established decades ago. Many of these design-defining load cases are insufficient and irrelevant in an ecommerce context. Also, for traditionally design packaging, the most challenging load case was the “last mile” was under the watchful control of the consumer in the trunk of their car. Relative to well protected, upright bottles/cartons packaged in RSC cases, for example, the combination of drop loading, random package orientation and package-package interaction seen in ecommerce distribution frequently results in package damage such as buckling, rupture, progressive leakage, unconstrained movement and/or label damage that, by all traditional CPG quality metrics, would be characterized as unsalable or off-quality product. Figure 1.

Figure 1. E-commerce delivery of two multi-layer shelf-stable cartons of liquid food products.

The damaged packages shown in Figure 1 represent the most significant sustainability loss of all because all the energy and materials used to manufacture, package, and transport the product are wasted. These same multi-layered carton packages perform well when transported on a pallet in a 6- or 12-pack RSC case and displayed individually on a store shelf. However, they are structurally inadequate for e-commerce distribution because the forces acting on the packages make the design vulnerable to failure.

If a package must survive both distribution modalities, as in Figure 1, avoidance of structural failure requires a design and material solution specific to this situation. Cushioning, case size, and other companion products that may be in a parcel delivery cannot be predetermined or relied upon to protect the product. The alternative, outside of package reuse or return, is for a CPG company to develop two different packaging systems and operate them on two (or more) different filling/packing lines. In the US the question of different package designs and filling and packing lines for different consumer distribution models is driven largely by cost. In the EU the question of multiple manufacturing lines and the calculus of total “product system sustainability” will draw in the manufacturing-related regulatory oversight of the Digital Product Passport Directive and may be a pathway for multiple package systems for the same products.

Liquids Packaging Materials

The workhorse materials of the consumer products and food and beverage industries for liquid containment are polyethylene, polypropylene, and PET. All are recyclable, but in the case of polypropylene, the recycling capacity is far less than the others. Although advances in plant-based and other materials offer new opportunities for sustainability, for the foreseeable future there are no practical plastic replacement candidates at scale. As a result, sustainability improvement for rigid packaging is generally limited to optimizing the use of these three core materials for the specific application and distribution method. Structural optimization to achieve minimum material usage while achieving acceptable product containment has been and remains the focus of most rigid packaging sustainability initiatives. Significant advances in predictive analysis methods that enable optimization of packaging for either distribution approach have resulted in many billions of pounds of material savings already. [Improve Sustainability with Tray-Based Unit Loads ]

Molded Fiber Bottles

Driven by society’s demand for more sustainable structural material options and no real scalable polymer alternatives for liquid packaging, molded fiber packaging with an internal (non-structural) bag bonded to a conventional closure sealing system has gained momentum (Figure 2). This package form is a very positive innovation that leverages renewable resources and can accommodate complex brand-focused shapes while minimizing the use of plastic materials. Fiber-based packaging is well aligned with the spirit of the Package and Packaging Waste Directive. However, the significant challenge to molded fiber packaging is strength and durability for both palletized distribution to the store shelf and particularly, the rough and tumble world of e-commerce distribution (Sustainable Bottle Design: Molded Fiber vs. HDPE Reality). When shipping liquid-filled packages in molded fiber containers it is common to see extra dunnage in the box, in addition to an over-bag (Figure 3), both of which are contrary to sustainability initiatives in general and contrary to the goals of the PPWD objectives specifically. Fiber-based packaging also faces scalability controversies (Packaging drives pulp’s deforestation risks (innovationforum.co.uk) because of its demand for wood fibers, albeit renewable. The commercially more mature cousin to molded fiber packaging, bag-in-box, is also an alternative to rigid plastic packaging but generally shares similar limitations and environmental impact concerns as fiber packaging.

Figure 2. Molded fiber bottle for liquids.

Figure 3. Molded fiber bottle as received from an e-commerce shipment.

Liquid Package Seal Leakage

The transition from traditional brick-and-mortar sales to e-commerce home parcel delivery has resulted in a costly and wasteful crisis associated with closure leakage in the liquid product category (excluding beverages), particularly for high-density polyethylene bottles with polypropylene closure systems (Figure 4).

Figure 4. Most all sealing systems on liquids packaging are designed for a, primarily, “stand-up” orientation. Design, dimensional variability inherent in injection and blowing molding, and capping line variability can impact the integrity of sealing systems, making them vulnerable to leakage when in a non-upright orientation. In parcel distribution, there is no control of orientation while in traditional case-based packaging, the bottle typically remains upright with no fluid on the seal.

Figure 4. Most all sealing systems on liquids packaging are designed for a, primarily, “stand-up” orientation. Design, dimensional variability inherent in injection and blowing molding, and capping line variability can impact the integrity of sealing systems, making them vulnerable to leakage when in a non-upright orientation. In parcel distribution, there is no control of orientation while in traditional case-based packaging, the bottle typically remains upright with no fluid on the seal.

Figure 5: Bottles of liquid-containing products are typically owe-wrapped or over-bagged to prevent losses of other products if leakage occurs.

Parcel delivery leakage is uniquely problematic because the leaking liquid can damage other parcels in the delivery vehicle. The industry has dealt with this problem by requiring an over-bag/over-wrap to contain the liquid contents if the seal is defeated as a result of orientation in the box, compressive squeeze loading caused by other products in the parcel, or drop impact rupture (Figure 5).

Figure 5: Bottles of liquid-containing products are typically owe-wrapped or over-bagged to prevent losses of other products if leakage occurs.

The addition of the over-wrap as an additional feature to mitigate liquid damage is not foolproof. Rather, the overwrap is another manufacturing operation that can introduce its own unique failure mechanism that was otherwise non-existent in traditional distribution, as shown in Figure 6.

Figure 6. A shrink-style overwrap is used to contain the fluid if leakage occurs. However, this package was received with the seam of the overwrap split during parcel handling.

In addition to an over-bag, the other common “belt and suspenders” approach is to add excess cushioning dunnage in the box. All of these leakage accommodation practices are directionally opposite to all sustainability goals in general and are specifically targeted for elimination by the Packaging and Packaging Waste Directive.

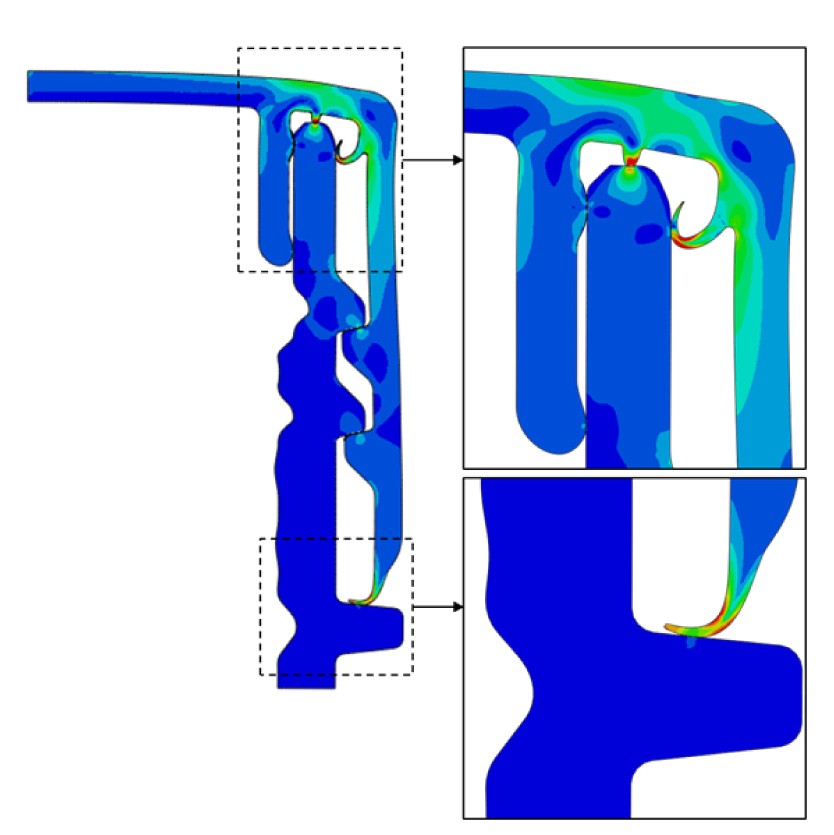

Predictive Modeling and Simulation

Neither the EU PPWD Directive nor US commercial initiatives contemplate that all forms of liquids (or other) packaging will evolve to reuse or refill formats. As such, CPG’s that plan to offer products through both ecommerce and brick and mortar channels will need to refine their bottle and closure development methods and design science to accommodate the rigors of ecommerce for sealing. Closure sealing system design methods will need to be created, as was done in the 1980’s when reliable plastic-on-plastic seals generally displaced gasketed/liner closure seals. This is another role for digital predictive modeling and simulation. Predictive digital methods exist that accelerate the development of these advanced closure systems in an environment that enables performance optimization while reducing cost (Figure 7).

Techniques developed by Stress Engineering Services in the mid-1980s are not being offered through SaaS models to enable easier access to technology and experience of Stress Engineering and Force-4 Product Development.

Where Does “The Brand” and the Consumer Fit in Sustainable Packaging

E-commerce is new and drastically changes the product branding understanding and strategies of establishing “shelf presence” and the “First Moment of Truth” [reference] in the CPG category. Marketers and brand owners will need to reinvest in new research and develop new approaches to represent their brands to accommodate the regulatory and/or consumer-derived constraints in the emerging world of sustainability and e-commerce. In the US where regulatory pressure is (currently) light, the consumer will dictate the balance between convenience and preference relative to shape, color, decoration, features, and ultimately cost. In the EU where there is stronger regulatory influence, manufacturers will need to find new mechanisms to communicate their unique, differentiating messages to the consumers on the new canvas of sustainable packaging for products delivered in a (typically) nondescript case with cushioning materials and other bespoke products.

About Stress Engineering Services, Force-4 Product Development, and ALOE Group logistics.

Stress Engineering Services and its package development and engineering logistics divisions, Force-4 and ALOE Group have more than three decades of experience developing packaging systems for consumer products companies around the globe, including sustainability and e-commerce applications. SES is partnering with Amazon Web Services (AWS) to bring cloud-based access to the computational technologies and domain expertise that is the foundation of SES’s success in packaging development. In late 2023 AWS and SES will launch The SES Sustainability Workbench. The Workbench will provide access to proprietary software tools and blended tools and services otherwise not available.

Ref: W005-SP-DPP EU Green Deal Impact CPG_061523

Keep in touch with us.

Sign up for our newsletter.